California Tax Brackets 2024 Capital Gains. The finance bill, 2024, has been introduced by the fm to rationalize capital gains provisions. The budget 2024 has overhauled the provisions relating to capital gains effective 23 july 2024.

A qualified dividend is a payment. Tax brackets and capital gain tax rates are normally based on “taxable income,” which is line 15 on the.

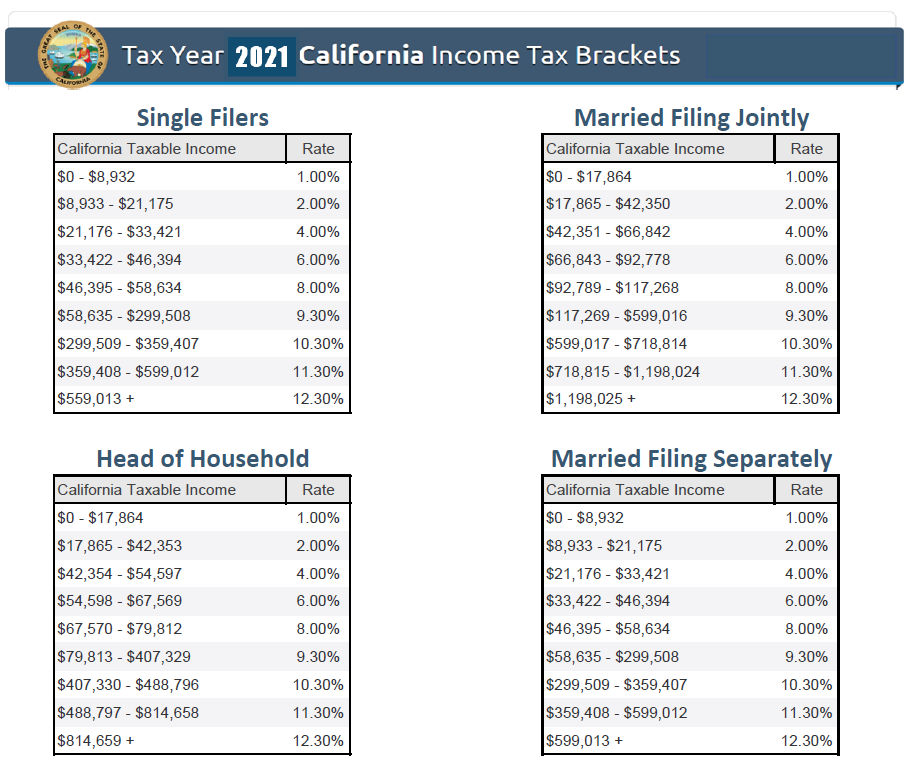

The Tax Brackets In California Range From A Low Of Just 1% To A High Of 12.3%.

You receive capital gains when you sell a capital asset, like stocks , real estate, or collectibles, for a profit.

Our Capital Gains Tax Calculator Determines Your Capital Gains Amount, Taxes Owed, And Tax Rate.

The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how.

California Tax Brackets 2024 Capital Gains Images References :

Source: livyqruthanne.pages.dev

Source: livyqruthanne.pages.dev

2024 Long Term Capital Gains Tax Calculator Chris Delcine, Capital gains rates for individual increase to 15% for those individuals with income of $44,626 and more ($89,251 for married filing joint, $44,626 for married filing separate,. Tax brackets and capital gain tax rates are normally based on “taxable income,” which is line 15 on the.

Source: aftonbanna-diane.pages.dev

Source: aftonbanna-diane.pages.dev

2024 Tax Brackets California Sally Consuelo, For example, california taxes capital gains as regular income with a top tax. You receive capital gains when you sell a capital asset, like stocks , real estate, or collectibles, for a profit.

Source: aftonbanna-diane.pages.dev

Source: aftonbanna-diane.pages.dev

2024 Tax Brackets California Sally Consuelo, We've got all the 2023 and 2024 capital gains. California's 2024 income tax ranges from 1% to 13.3%.

Source: andreiqsharyl.pages.dev

Source: andreiqsharyl.pages.dev

2024 Long Term Capital Gains Tax Brackets Tatum Lauryn, Apply the appropriate tax rate: See more on state capital gains tax rates in 2024.

Source: jenniqrianon.pages.dev

Source: jenniqrianon.pages.dev

Capital Gains Tax 2024 Irs Birgit Steffane, Tax brackets and capital gain tax rates are normally based on “taxable income,” which is line 15 on the. See more on state capital gains tax rates in 2024.

Source: brynasarine.pages.dev

Source: brynasarine.pages.dev

What Is The Long Term Capital Gains Tax 2024 Amii Lynsey, We've got all the 2023 and 2024 capital gains. Our capital gains tax calculator determines your capital gains amount, taxes owed, and tax rate.

Source: adeyqrosaline.pages.dev

Source: adeyqrosaline.pages.dev

Capital Gains Tax Rate 2024 California Cecily Tiphani, The budget 2024 has overhauled the provisions relating to capital gains effective 23 july 2024. Apply the appropriate tax rate:

Source: brandyqeachelle.pages.dev

Source: brandyqeachelle.pages.dev

California State Tax Brackets 2024 T3 Adena Arabela, Capital gains rates for individual increase to 15% for those individuals with income of $44,626 and more ($89,251 for married filing joint, $44,626 for married filing separate,. 1%, 2%, 4%, 6%, 8%,.

Source: demetriswjoice.pages.dev

Source: demetriswjoice.pages.dev

Tax Brackets 2024 California State Calley Jolynn, In this comprehensive guide, we will explore the nuances of california's capital gains tax landscape, including recent updates, exemptions, strategies for minimizing tax liability, and the role of federal regulations. All capital gains are taxed as.

Source: monahrafaelia.pages.dev

Source: monahrafaelia.pages.dev

California State Sales Tax 2024 Calculator Donia Jasmine, You receive capital gains when you sell a capital asset, like stocks , real estate, or collectibles, for a profit. All capital gains are taxed as.

For Example, California Taxes Capital Gains As Regular Income With A Top Tax.

One of the most notable changes is the harmonization of tax rates.

You Receive Capital Gains When You Sell A Capital Asset, Like Stocks , Real Estate, Or Collectibles, For A Profit.

The budget 2024 has overhauled the provisions relating to capital gains effective 23 july 2024.